ভ্যাট এবং ট্যাক্স স্কুল (VAT & TAX SCHOOL )ব্যবসায়ী থেকে শুরু করে সকল শ্রেণীর করদাতাদের বিভিন্ন ভাবে প্রফেশনাল সেবা দিয়ে থাকে. যেমন

*টিআইন সেবা,

*অনলাইন বা অফলাইন বা উভয় ক্ষেত্রে আয়কর রিটার্ন দাখিল সেবা,

*কোম্পানী বা ব্যবসা প্রতিষ্ঠান গঠন সম্পর্কিত সেবা (RJSC)

*ভ্যাট নিবন্ধন এবং মাসিক রিটার্ন দাখিল (BIN)

**কোম্পানির আর্থিক বিবরণী প্রস্তুতকরণ ,অডিট রিপোর্ট এবং আয়কর রিটার্ন দাখিল

*ট্রেড লাইসেন্স সেবা

*অডিট রিপোর্ট একটাই হবে- Bank, Tax and VAT Office

VAT & TAX School YouTube channel helps public to get proper knowledge about Accounting, TAX, VAT, Customs, Banking, and professional viva related matters. So please subscribe my channel to get more updated information about TIN, BIN, VAT, Trade License, TAX, Customs, Banking viva, accounting and business studies related matters.

#TIN, #BIN, #VAT, TAX, #income tax, #Corporatetax, #ereturn #Vatonlineservice, #incometaxonline #Sanchaypatra , #Zerotaxreturn #Banking #Bankingoperation #Tradelince #Valueaddedtax #Incometax

Shared 2 weeks ago

303 views

Shared 2 weeks ago

176 views

VAT Compliance for purchase from unregistered entity 2026/Compliance if purchased from an unregis...

Shared 2 weeks ago

100 views

RJSC new Update 2026. Society/Association, Club, Trust, Foundation Registration and Return Filing...

Shared 2 weeks ago

142 views

Are you a government employee? Check how much your salary will increase in the new pay scale. Pay...

Shared 3 weeks ago

98 views

How to show AIT( Advance Income Tax) Against Import under Section 120 in eReturn?Claim AIT on import

Shared 3 weeks ago

281 views

Force Registration for VAT./How to update VAT Profile? How to update the dropdown box in VAT Online?

Shared 4 weeks ago

180 views

Income Tax Return Process. Section 181. Income Tax Act 2023. Income Tax Return Process. tax Retur...

Shared 1 month ago

192 views

Shared 1 month ago

358 views

Shared 1 month ago

2.2K views

Shared 1 month ago

418 views

Shared 1 month ago

1K views

What is spot assessment? In which cases is tax assessed on the spot? According to which section?/...

Shared 1 month ago

108 views

Shared 1 month ago

78 views

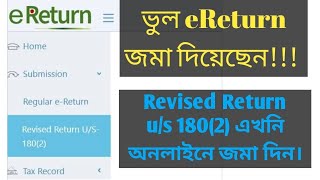

How to submit revised Ereturn u/s 180(2) in Online/Revised Return/Revised Income Tax Return 2025-...

Shared 1 month ago

654 views

What are the income sectors covered by minimum tax? In which sector, if there is tax at source, i...

Shared 1 month ago

546 views

What are the matters to be checked from IT10B Assets, Liabilities and Expenses statements of Return?

Shared 1 month ago

676 views

Shared 1 month ago

402 views

Shared 1 month ago

182 views

15 reasons why income tax files may fall under scrutiny/audit?/Reasons for falling Tax return in ...

Shared 2 months ago

496 views

What documents and information are required to get a BIN Certificate? Required Documents for VAT/...

Shared 2 months ago

273 views

Shared 2 months ago

591 views

Shared 2 months ago

444 views

While filling eReturn, which one should you select Resident or Non-Resident? Select Residential S...

Shared 2 months ago

218 views

Revised eReturn 2025-2026!!!/Have you submitted an incorrect eReturn for the 2025-2026 tax year? ...

Shared 2 months ago

983 views

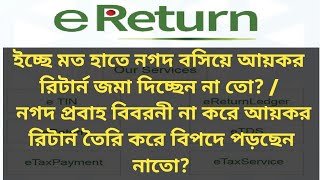

Is there too much cash on hand in your income tax return? Want to reduce it? Are you showing your...

Shared 2 months ago

1.4K views

Can tax paid at source, advance income tax payment, and tax paid at the time of filing the return...

Shared 2 months ago

761 views

Shared 2 months ago

1K views

Shared 2 months ago

2.6K views

Error in income tax calculation for fiscal year 2025-26! Is NBR losing revenue? Final tax liabili...

Shared 2 months ago

1.4K views

eReturn এর Additional Information কোথায়, কিভাবে পুরন করবেন?Additional Information/eReturn 2025-2026

Shared 2 months ago

395 views

Shared 3 months ago

528 views

Shared 3 months ago

367 views

Shared 3 months ago

806 views

আপনার জমানো টাকা( হাতে নগদ, ব্যাংক জমা ও অন্যান্য কোথায়, কত টাকা দেখাবেন ২০২৫-২৬ করবর্ষের eReturn এ

Shared 3 months ago

4.1K views

Gold, Diamond, Platinum এগুলোর মুল্য কি জিরো? ক্রয়/দান/ উত্তরাধিকার হলে? বিক্রি হলে কর দিতে হবে কি?

Shared 3 months ago

1.9K views

Sanchaypatra eReturn New update 2025/ 5% tax adjustment at source on savings account Sanchaypatra...

Shared 3 months ago

4.9K views

Shared 3 months ago

775 views

Are you trying to make a deal with a pile of cash in your hand? Filing income tax returns without...

Shared 3 months ago

17K views

Shared 3 months ago

780 views

Shared 4 months ago

730 views

How to show FDR,FDR Interest, Tax Deduction at sources, Closing Balance, Encashment in eReturn 2025?

Shared 4 months ago

1.3K views

Shared 4 months ago

1.6K views

Shared 4 months ago

3.2K views

Shared 4 months ago

505 views

Shared 4 months ago

353 views

১ম আয়কর রিটার্ন জমা দিচ্ছেন?৫টি ভুল করলে বিপদে পড়বেন?/Income Tax Return Errors/1st eReturn 2025-26

Shared 4 months ago

805 views

Shared 4 months ago

432 views

Shared 4 months ago

336 views

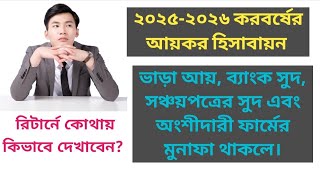

See income tax calculation for a retired government employee for the tax year 2025-2026 with exam...

Shared 4 months ago

3.7K views

How to cancel TIN Certificate Online?/ Rules or reasons for canceling TIN certificate online 2025...

Shared 4 months ago

615 views

Shared 4 months ago

893 views

Commercial Importer's eReturn 2025-2026/Commercial Importer's Online Income Tax Return Submission...

Shared 4 months ago

503 views

Shared 4 months ago

164 views

Shared 4 months ago

948 views

TIN Cancel is possible in Inline?/Error Correction Application is Approval/TIN User ID,Password-2025

Shared 4 months ago

551 views

Shared 5 months ago

5.6K views

Shared 5 months ago

500 views

How to calculate income tax for the 2025-2026 tax year if the individual (foreign) taxpayer is a ...

Shared 5 months ago

312 views